- MDA Space recently signed a Memorandum of Understanding with South Korea’s Hanwha Systems to explore collaborating on Korea’s sovereign Low Earth Orbit (K-LEO) defence constellation using its AURORA software-defined digital satellites.

- This potential role in a national security-focused satellite network underscores growing international interest in MDA’s flexible, dual-use space technology for defence applications.

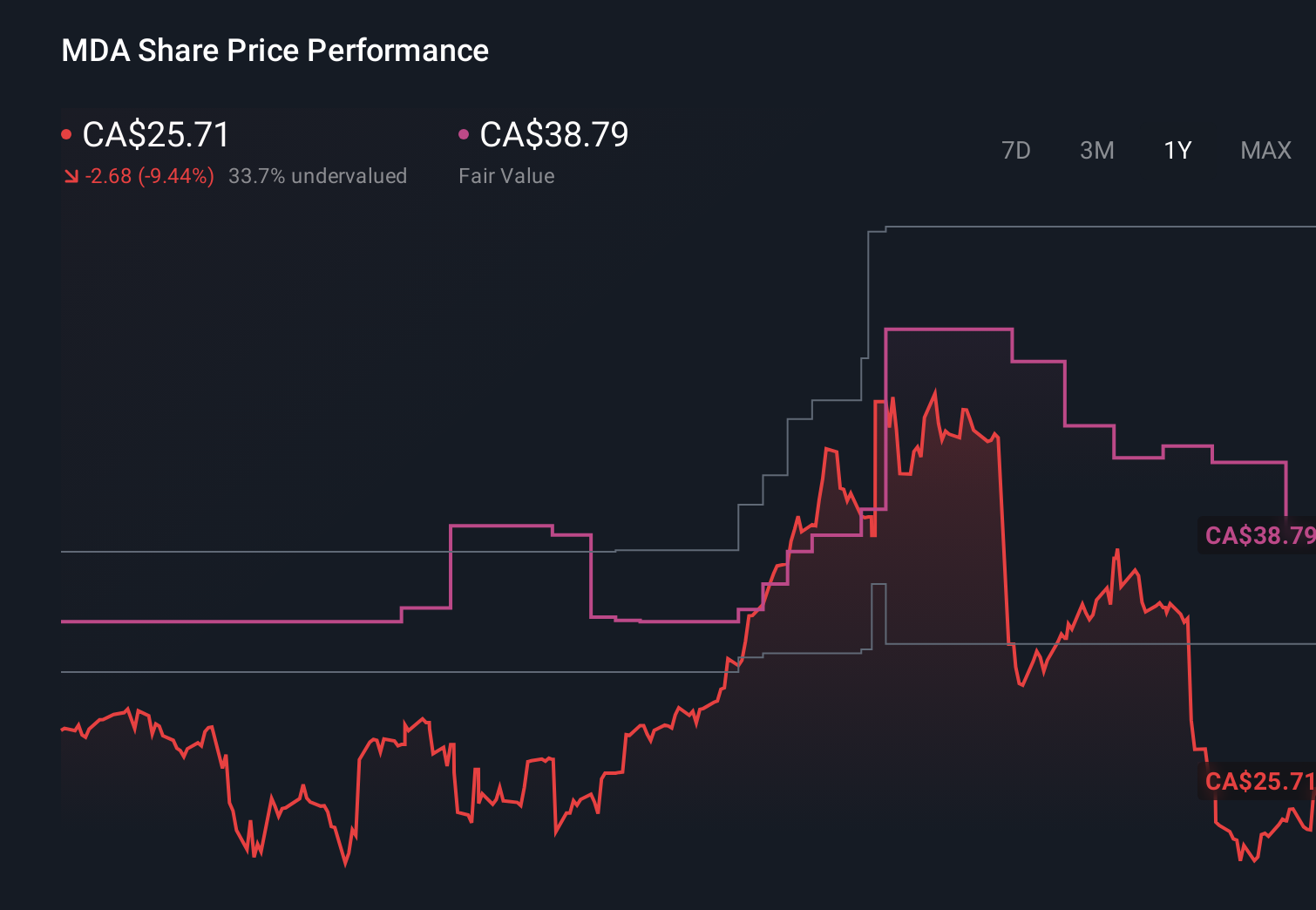

- We’ll now examine how this K-LEO collaboration focus shapes MDA Space’s investment narrative in light of its recent share price performance.

Find companies with promising cash flow potential yet trading below their fair value.

What Is MDA Space’s Investment Narrative?

To own MDA Space, you really have to believe in its ability to translate sophisticated, dual‑use technology into long-duration defence and government programs, while justifying a rich valuation after a very strong share price run. The Hanwha K‑LEO MoU fits that story neatly: it reinforces AURORA as a platform that foreign defence partners are at least willing to evaluate, alongside the recent U.S. SHIELD IDIQ and Canadian ESCP-P commitments. That said, an MoU is not a contract, so this news does not yet change the near-term revenue picture in a material way, nor does it remove key risks such as execution on existing programs, balance sheet discipline after the CA$250,000,000 notes issue, or potential multiple compression if growth or contract wins do not keep meeting high expectations.

However, one key risk is that current expectations already assume a lot going right.

MDA Space’s shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.

Exploring Other Perspectives

Seventeen members of the Simply Wall St Community put MDA Space’s fair value anywhere from about CA$16 to CA$55, with many clustering well below recent trading levels. Set that against a business where fresh defence MoUs and IDIQ eligibility may support the story, yet still leave investors exposed if contract conversion, execution or margins fall short of what the current valuation appears to price in. These contrasting views underline why it can help to compare several independent takes before deciding what the stock is really worth.

Explore 17 other fair value estimates on MDA Space – why the stock might be worth less than half the current price!

Build Your Own MDA Space Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes – extraordinary investment returns rarely come from following the herd.

- A great starting point for your MDA Space research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free MDA Space research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate MDA Space’s overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don’t miss this chance:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Try a Demo Portfolio for Free

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

link